Introduction

Pricing has a huge impact on profitability. Pricing strategies vary considerably across industries, countries and customers. Nevertheless, researchers generally concur that pricing strategies can be categorised into three groups:

- cost-based pricing;

- competition-based pricing; and

- customer value-based pricing.

Of these, customer value-based pricing is increasingly recognised in the literature as superior to all other pricing strategies (Ingenbleek etal., 2003). For example, Monroe (2002,p. 36) observes that: ‘‘ . . . the profit potential for having a value-oriented pricing strategy that works is far greater than with any other pricing approach’’. Similarly, Cannon and Morgan (1990) recommend value pricing if profit maximisation is the objective, and Docters et al. (2004, p. 16) refer to value-based pricing as ‘‘one of the best pricing methods’’.

Practitioners have also recognised the advantages of value-based pricing strategies. Several companies have successfully adopted such strategies. These include pharmaceutical companies such as Sanofi-Aventis, information technology companies such as SAP and Vendavo, wireless internet service providers such as the Australian company Xone, airlines such as Lufthansa, vehicle manufacturers such as BMW, and biotech companies such as Tigris Pharmaceuticals.

The increasing endorsement of customer value-based strategies among academics and practitioners is based on a general recognition that the keys to sustained profitability lie in the essential features of customer value-based pricing, including understanding the sources of value for customers; designing products, services, and solutions that meet customers’ needs; setting prices as a function of value; and implementing consistent pricing policies.

Despite the obvious benefits of customer value-based approaches to pricing, a review of the literature suggests that these methods still play a relatively minor role in pricing strategies. It is apparent that various obstacles must lie in the way of a more widespread implementation of value-based approaches to pricing. The purposes of the present study are to identify these obstacles and to suggest guidelines for overcoming them. The next section of the paper presents the theoretical background for the study, including consideration of alternative pricing strategies and the frequency of implementation of these strategies. The research methodology of the present study is then explained followed by a presentation of the findings with regard to the major obstacles that prevent the effective implementation of value-based pricing. Remedies for these obstacles are also discussed.

The wide array of pricing strategies

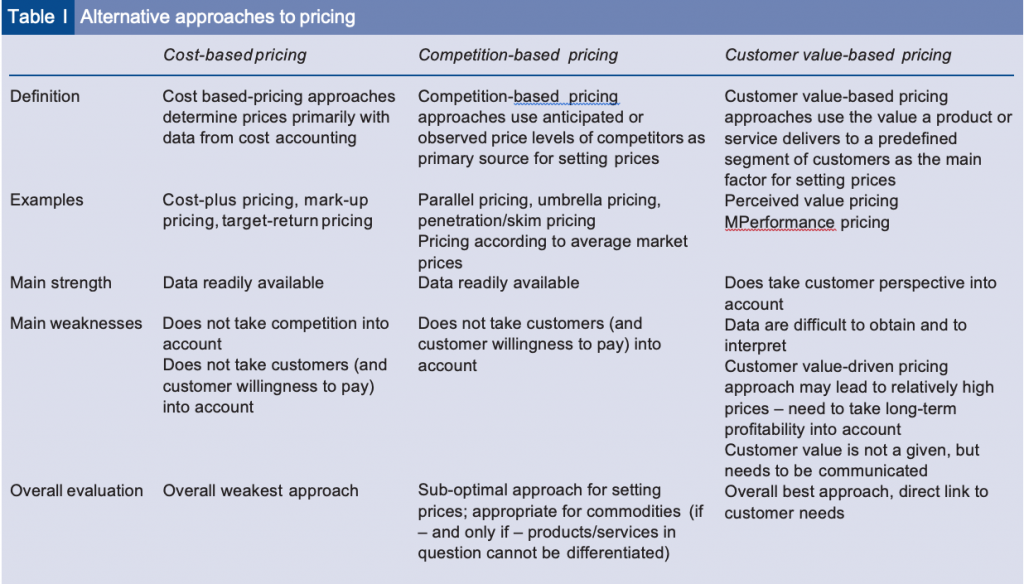

Cost-based pricing derives from data from cost accounting. Competition-based pricing uses anticipated or observed price levels of competitors as primary source for setting prices and customer value-based pricing uses the value that a product or service delivers to a segment of customers as the main factor for setting prices.

Table I summarises the major characteristics of these various approaches. As shown in the table, each of these strategies has its strengths and weaknesses. The advantage of the first two methods is that data are usually readily available, but their disadvantage is that they do not pay sufficient attention to customer needs and requirements. Conversely, customer value-based methods do take the customer perspective into account, but relevant data are more difficult to obtain and interpret.

Marketing researchers recognised the inherent problems of cost-based pricing approaches as long ago as the 1950 s. For example, Backman (1953, p. 148) notes that ‘‘. . .the graveyard of business is filled with the skeletons of companies that attempted to base their prices solely on costs’’. More recently, Myers et al. (2002) assert that cost-based pricing produces sub-standard profitability; similarly, Simon et al. (2003) contend that cost-based pricing leads to lower-than-average profitability.

Ingenbleek et al. (2003) demonstrate the advantages of valued-based pricing. In an empirical survey of 77 marketing managers in two business-to-business industries (electronics and engineering) in Belgium, they find that customer value-based pricing approaches are positively correlated with new product success, whereas no such correlation is identified between new product success and the adoption of cost-based and competition-based pricing. The authors conclude that customer value-based pricing approaches are, overall, the best strategies to adopt in making decisions about new product pricing.

Implementing different strategies

Despite the fact that empirical research shows that value-based approaches are superior to other pricing approaches, it has not been widely adopted in practice.

To substantiate this claim, we have undertaken a comprehensive survey of all published literature on pricing approaches used in practice. This literature review covered close to two dozen empirical studies on pricing approaches actually used in the USA, Europe, and Asia, covering a broad range of industries (including industrial services, pharmaceuticals, IT, B2B industries, etc.) and spanning over two decades of research.

This literature review reveals that value-based pricing approaches remain in a significant minority. Figure 1 shows the results of this literature review.

It is apparent from Figure 1 that competition-based pricing approaches remain dominant in pricing practice. Their ‘average influence’ across all published surveys is found to be 44 percent (calculated as the average adoption rate in single-answer surveys and/or the average influence of competition-based considerations on product pricing in multiple-answer surveys). It is also apparent that cost-based pricing approaches, despite being acknowledged as the weakest approach to setting prices (Nagle and Holden, 2002), remain the second-most commonly adopted approach. Their ‘‘average influence’’ across all surveys was 37 percent. In contrast to the popularity of the first two approaches, customer-value approaches have an average influence of only 17 percent across all surveys.

Clearly, only a small minority of companies actually adopt value-based approaches in practice despite the fact that academics and practitioners alike are increasingly asserting that such customer-oriented approaches possess significant advantages over conventional pricing methodologies. The question of why this is so is addressed in the present study.

Research methodology

So far, little is known about specific obstacles preventing companies from pursuing customer value-based pricing. To investigate this phenomenon we employ a two-stage empirical approach: first, in a qualitative research, we explore the phenomenon of implementation of value-based strategies with groups of business executives participating in pricing workshops. The result of this qualitative stage was then used to develop a questionnaire which was tested upon a significantly larger and more stratified population. We finally employ cluster analysis to summarize the results of this quantitative research stage.

Qualitativeresearch

Qualitative research is useful to gain initial insight and understanding into a defined problem. If the research question is exploratory in nature, focus group research is appropriate (Seale, 2004).

In the context of a broader research project on successful pricing strategies, we discussed current pricing practices with 30 business executives responsible for pricing decisions from Germany, Austria, and Switzerland in pricing workshops organized by a consultancy specializing in pricing. The two-day workshops were held in three different locations in Germany during the October-December 2005 period. The objective was to understand the degree of familiarity these executives had with alternative approaches to pricing, in particular with customer value-based pricing strategies, and to understand which pricing approaches had already been adopted. Particular emphasis of these focus group discussions were on customer value-based pricing strategies, obstacles to their implementation, circumstances under which implementing value-based pricing strategies was more/less likely to be successful, examples of companies moving successfully to value-based pricing and examples of companies less successful in this respect.

Quantitativeresearch

A sample of 126 marketing managers, business unit managers, key account managers, pricing managers, and general managers were initially recruited for this study. These managers participated in in-house pricing workshops which the author conducted in the period 2006-2007. Companies represented included automotive, chemicals, information technology (IT), chemicals, industrial services and fast moving consumer goods. We held nine workshops at nine different companies in Germany, Austria, China, and the USA. The study design is thus cross-sectional, multi-country, and multi-industry.

Results and discussion

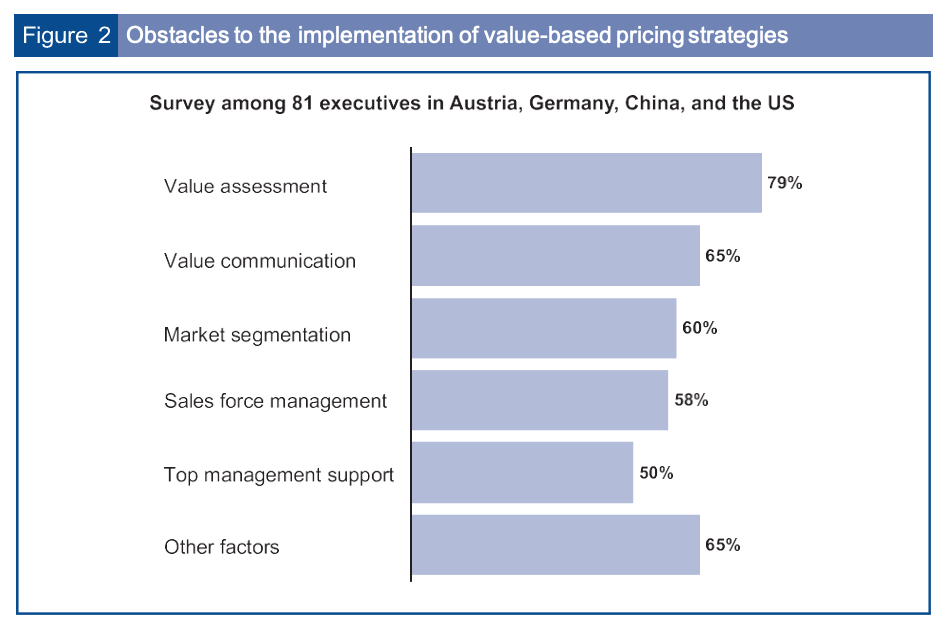

In response to questions about the obstacles to implementation of value-based pricing, a wide array of answers was received (with multiple answers being allowed and encouraged). As shown In Figure 2, six main obstacles were identified after clustering responses:

Difficulties in making valueassessments

The difficulties associated with reliable assessment of value are reflected in the following comment from the chief marketing officer of a software company:

The research and development department came up with a new software program to help large retailers compare the prices of thousands of competitive products on the Internet in real time. This program helps them to adjust their own prices not only on the basis of data from internal demand, but also on the basis of the prices of competitors, which are usually much harder to get because Internet-based price comparison engines typically do not list prices for toothbrushes, pet-food, beer, and so on. We know there is value in this program for such retailers as Wal Mart, K-Mart, and so on. However, we just do not have the tools to attach a financial value to our unique software package.

Respondents in the pharmaceutical, chemical, and fast-moving consumer goods industries stated that similar difficulties were the primary obstacle to their implementation of value-based pricing strategies. If the company itself does not know the value of its products or services to customers, how does it know what to charge customers for value?

The most effective way of overcoming the value-assessment problem is rigorous value measurement. In this regard, Nagle and Holden’s (2002) definition of value to the customer is pertinent: ‘‘A product‘s economic value is the price of the customer‘s best alternative reference value – plus the value of whatever differentiates the offering from the alternative – differentiation value.’’

Drawing on this definition, the following methodologies for measuring value to customers are worthy of note:

B Expert interviews. Company experts (such as senior representative from the marketing, product management, key account management, pricing, sales, controlling, and finance departments) can be asked to estimate the customer value of new offerings in laboratory tests or brainstorming sessions. Consensus should be sought. If expert personnel inside the company have diverging or ambiguous views on what constitutes value for the customer, there is no basis upon which to build pricing strategies that reflect value.

B Focusgroupassessmentofvalue.Customers in groups of 5-15 can be asked to evaluate the importance and impact of new product concepts. Such focus groups are a useful means of hearing the voice of the customer and can also be used to obtain estimates of expected price ranges for new concepts.

B Conjoint (or trade-off) analysis. In accordance with the methodology suggested by Auty (1995), a research survey of customers’ evaluations of a set of potential product offerings can be undertaken. Each offering should consist of an array of specific attributes, with the levels of these attributes being systematically varied within the set of offerings. Respondents are then asked to provide their purchase preference ranking for each of the offerings. Statistical analysis is then used to identify the value that the respondents place on each attribute. Such ‘‘conjoint analysis’’ is probably the most widely used tool to measure customer value. It has the advantage of enabling firms to capture the value of intangible product features (brand names, reputation, and so on) and the value of features about which direct questioning might lead to unreliable results (such as the value of superior delivery reliability, superior service, and so on). However, it has the disadvantage of failing to ascertain the value of features that are not included in the design of the questionnaire.

B Assessment of value-in-use. Customers can be observed and interviewed when they are actually using new offerings to obtain estimates of customer value. Such value-in-use assessments enable assessment of customer satisfaction and customer dissatisfaction (in terms of product and service dimensions) as customers experience them in their daily use. Such assessments are useful for uncovering unmet customer needs or problems that customers would not voice in laboratory tests or in response to direct questioning.

B Importance ratings. Based on the conceptual work of Kano, the methodology of Matzler etal.(1996) ask customers to respond to a questionnaire by indicating the importance of (and satisfaction with) a set of existing and new product attributes. Answers to these questions are then used to estimate the customer value of existing and new product offerings. Customer value is considered highest when perceived customer importance for a new concept is high and, simultaneously, satisfaction with current product offerings is low. If conducted exhaustively, importance ratings enable companies to identify instances when they are ‘‘over-fulfilling’’ customer requirements and instances when customers still require more satisfactory solutions.

In practice, the most reliable assessments of customer value are likely to be obtained by using several of these suggested tools concurrently. For example, a firm might first undertake internal expert assessments to obtain consensus regarding the presumed value to customers of various features. Qualitative customer input might then be sought through focus groups or field value-in-use assessments. Subsequently, these findings might be validated by means of a broad quantitative survey (such as conjoint analysis).

Difficulties with communicatingvalue

A deficit in communication of value was the second most common obstacle to implementing value-based pricing strategies in the present study. A global marketing manager in the chemical industry put it this way:

Our new chemical product had some advantages over its direct competitor. Our question at the time of the launch was whether we should base our marketing campaign around this advantage or whether we should stress other features in which our company held an advantage. In the end, we decided to communicate distinctive product features, but we learnt the hard way that customers simply did not care. . . So today I am still struggling with regard to the most effective way of communicating with customers in ways that matter and are meaningful to them.

Effective communication of value is especially difficult in environments where customers are inundated with advertising. The marketing managers in the study reported that it has become increasingly difficult in the past 10-15 years to get their customers’ attention. Customers are inundated with television advertisements, print advertisements, internet ‘spam’, and various other sales tactics and tend to adopt a negative view of marketing. Customers are increasingly difficult to reach and impress through traditional marketing channels, and they tend not to respond well to traditional marketing tactics – unless these tactics are so creative, unusual, and impressive that they clearly stand out.

To improve the communication of value to customers, three levels of sophistication need to be recognised and used appropriately:

- Communicating product features. The most basic level of communication of value is to advise customers of product features (for example, cars with a 300 hp motor; or chemicals with 95 percent efficacy against a given pest). The problem with this approach is that customers often do not care about product features.

- Communicating customer benefits. On a more sophisticated level, communication of value refers to customer benefits (for example, insulation that reduces noise; or headphones that are more comfortable). The advantage of this approach is that customers do care about benefits; the disadvantage is that companies do not always know which benefits really matter to customers.

- Communicating benefits in accordance with customer needs. At the most sophisticated level of communication, the needs (explicit or implicit) of customers are addressed. In these cases, the message is received and remembered because needed benefits, rather than features, are communicated. A good example is the advertising campaign of Michelin tyres, which focused on the safety of children in cars, thus communicating customer benefits that were in accordance with customer needs.

Difficulties with marketsegmentation

A senior product manager of a global company explained the obstacle of market segmentation to value-based pricing:

We had developed a new yoghurt with health benefits that I planned to launch at a premium price. However, I was frustrated because I could not get any of my colleagues (in marketing, sales, or key account management) to support my plan for a higher price. All I kept hearing was: ‘‘The customer cares only about price! Purchasing agents for supermarkets benchmark you against their own in-house labels – so forget your premium prices’’. So I gave up. We did not launch the product because launching it at parity to competition would not have allowed us to reach our profitability targets. The irony was that, half a year later, a competitor launched a similar product to the one we had just dropped – at 60 percent premium!

Market segmentation is difficult. In examining the impact of marketing theory on marketing practice, Webster (2005) noted that ‘‘for the past two decades, the tactical dimension has dominated. . . Mistakenly, the sum of the ‘four Ps’ was labelled as ‘marketing strategy’, even though the most important of the marketing variables – market segmentation, targeting, positioning – . . . were not part of this tactical formulation.’’

In short, marketing theory has not produced effective guidance for marketing practice on the key issue of market segmentation.

The best approach to market segmentation is one that takes customer needs as the primary segmentation variable. Such a needs-based market segmentation enables marketing and pricing strategies to cater to a variety of market segments rather than being restricted to the segment that is presumed to care only about price. An effective needs-based market segmentation not only identifies the size and composition of the price-driven market segment (which is never 100 percent of the market), but also delineates the nature and size of other market segments of customers (for whom product dimensions other than price have value).

The agrochemical company, Monsanto, used a well-defined, needs-based market segmentation for its ‘Roundup’ product, the world’s best-selling herbicide. Three market segments were identified:

- a price-driven segment of customers (who were offered a generically labelled product);

- a mainstream segment (who were offered a ‘‘Roundup’’ branded product); and

- a technically sophisticated segment (who were offered a product called ‘‘Roundup Weather Max’’, which was marketed as being very effective even under difficult weather conditions).

Using this needs-based approach to market segmentation, Monsanto was able to maintain a 60 percent share of the global herbicide market even though the patents expired in 2001 and cheaper substitutes were readily available. This example shows that a creative needs-based approach to market segmentation can be an effective marketing strategy – even with an apparently ‘‘boring’’ product, for which, it might be assumed, price would be the only relevant segmentation variable.

Difficulties with sales forcemanagement

The fourth most common obstacle was difficulties with sales force management. One workshop participant, from the automotive industry, put it this way:

We had just launched a new car. The press was excited, and the public loved it. Journalists put the car on their short lists for the ‘‘Car of the Year’’ award. Although the price of the new model was about 3,000 Euros (15 percent) above that of the previous model, we were all confident that we would be able to sustain this. . . But then, towards the end of the year, our sales team felt under pressure. Dealers had excess stock and offered significant cash discounts to customers. They also put pressure on our sales representatives to increase the annual allowances and bonuses to dealers. We partly gave in, but partly resisted. . . A year later we reviewed the actual net prices for sold cars. . .and realised that our targeted price premium of 3,000 Euros had actually evaporated to little more than 200 Euros.

As this case shows, value leakage often occurs at the level of sales teams as they attempt to realise annual volume targets and qualify for annual bonuses by extending discounts to customers. In many cases, they do so without understanding the long-term consequences of these discounts.

In many cases, they do so without understanding the long-term consequences of these discounts. Effective sales force management includes the establishment of clear guidelines regarding sales discounts, including:

- Level of authority for sales discounts. Restricting the authority of sales personnel to set prices can enhance profitability (Stephenson et al., 1979). However, in certain circumstances, sales personnel should be allowed greater latitude in setting prices to increase profitability; these circumstances include:

B cases in which sales personnel have greater insight into customers’ willingness to pay;

B cases in which sales staff possess outstanding negotiating skills;

B cases in which a willingness to pay varies substantially among customers; and

B cases in which products are complex or perishable.

- Sales force remuneration systems. Companies have traditionally rewarded sales personnel on the basis of sales volume, rather than profit. In contrast, value-based pricing strategies require a system that rewards sales personnel for profitability, rather than for sales volume or market share.

- Fixed and variable remuneration systems. If management wishes to encourage sales personnel to focus on sales volume, a lower percentage commission should be offered; conversely, if sales personnel are expected to focus on sales quality (such as developing customer relationships) a higher percentage commission should be offered.

- Sales force training and development. The effective implementation of value-based pricing requires a fundamental shift in the attitude of sales personnel and therefore entails a significant change in the way sales personnel are trained and developed. To identify the subtle wishes of customers, sales personnel must learn to become good listeners; moreover, they must learn to be comfortable in selling solutions (rather than products or services) to customers.

- Sales force monitoring. Value-based pricing requires target prices to be maintained and excessive discounts to be discouraged. Sales personnel should therefore be monitored to ensure that price discrepancies are promptly detected; in addition, financial incentives should be offered to sales personnel to maintain list prices and financial penalties should be imposed for excessive discounting (Sodhi and Sodhi, 2008).

Difficulties with senior managementsupport

Another important obstacle, mentioned by 50 percent of workshop participants, was a lack of support from senior management. A workshop participant from the industrial service industry said:

What really made value-based pricing difficult in our company was senior management claiming to want price premiums and profitability, but then punishing people for not meeting their volume quota.

Support from senior management can be obtained through various means, including lobbying, networking, and bargaining. If such support is gained, middle-ranking executives can then implement value-based pricing strategies. Recent research has shown that C-level executives are now handling pricing projects with increasing frequency (Jacobson, 2007).

It is the contention of this study that, once the various obstacles have been overcome using the suggestions and guidelines presented here, companies will be well-positioned to implement value-based pricing strategies.

References

Auty, S. (1995), ‘‘Using conjoint analysis in industrial marketing – the role of judgement’’, Industrial Marketing Management, Vol. 24, pp. 191-206.

Backman, J. (1953), PricePracticesandPolicies, Ronald Press, New York, NY.

Cannon, H. and Morgan, F. (1990), ‘‘A strategic pricing framework’’, JournalofServiceMarketing, Vol. 4, pp. 19-30.

Docters, R., Reopel, M., Sun, J. and Tanny, S. (2004), WinningtheProfitGame–SmarterPricing,Smarter Branding, McGraw-Hill, New York, NY.

Ingenbleek, P., Debruyne, M., Frambach, R. and Verhallen, T. (2003), ‘‘Successful new product pricing practices: a contingency approach’’, Marketing Letters, Vol. 14 No. 4, pp. 289-305.

Jacobson, T. (2007), ‘‘Global pricing transformations – the emotional, political, and rational aspects of getting to results’’, paper presented at the 18th Annual Fall Conference of the Professional Pricing Society, Orlando, October 26.

Matzler, K., Hinterhuber, H., Bailom, F. and Sauerwein, E. (1996), ‘‘How to delight your customers’’,

Journal of Product & Brand Management, Vol. 5 No. 2, pp. 6-18.

Monroe, K. (2002), Pricing – Making Profitable Decisions, 3rd ed., McGraw Hill, New York, NY.

Myers, M., Cavusgil, S. and Diamantopoulos, A. (2002), ‘‘Antecedents and actions of export pricing strategy’’, European Journal of Marketing, Vol. 36 No. 12, pp. 159-88.

Nagle, T. and Holden, R. (2002), StrategyandTacticsofPricing, 3rd ed., Prentice-Hall, Englewood Cliffs NJ.

Seale, C. (2004), Qualitative Research Practice, Sage, Thousand Oaks, CA.

Simon, H., Butscher, S. and Sebastian, K.-H. (2003), ‘‘Better pricing processes for higher profits’’,

Business Strategy Review, Vol. 14 No. 2, pp. 63-7.

Sodhi, M. and Sodhi, N. (2008), SixSigmaPricing–ImprovingPricingOperationstoIncreaseProfits, FT Press, Upper Saddle River, NJ.

Stephenson, R., Cron, W. and Frazier, G. (1979), ‘‘Delegating pricing authority to the salesforce – the effects on sales and profit performance’’, Journal of Marketing, Vol. 43 No. 1, pp. 21-8.

Webster, F. (2005), ‘‘Back to the future – integrating marketing as tactics, strategy, and organizational culture’’, Journal of Marketing, Vol. 69, October, pp. 4-6.

Further reading

Cespedes, F. and Piercy, N. (1996), ‘‘Implementing market strategy’’, Journal of Marketing Management, Vol. 12, pp. 135-60.